A private personal loan is one method to get hold of dollars You need to use when you make sure you. Even though $two,500 falls on the small conclusion of The everyday particular financial loan total, you’ll even now have to have to fulfill a number of prerequisites to get one.

Able to consider the start-up plunge Even though you don’t have any revenue? Examine our manual on the top methods to finance your budding business.

Editorial Notice: Intuit Credit Karma gets payment from third-party advertisers, but that doesn’t affect our editors’ viewpoints. Our third-get together advertisers don’t assessment, approve or endorse our editorial content material.

If permitted carefully evaluate the mortgage arrangement. Think about the desire price, repayment phrases and charges and ensure that you understand the overall price of the bank loan. Once you’re pleased with the terms indicator the settlement and Obtain your funds.

An origination cost is usually a expense of performing enterprise that a lender fees a nasty credit score borrower ahead of they even get the money. This price might be anywhere from 1% to ten% of the overall financial loan total based on the lender and your credit history rating.

For financial debt consolidation, In spite of a lower interest fee or lessen month to month payment, spending personal debt over a longer length of time could end in the payment of extra in desire.

Soon after selecting your very best mortgage give, you may post a formal financial loan application Along with the lender you picked. From there, you’ll wait about the lender’s acceptance selection.

A $two,500 private installment loan will affect your credit rating rating in a number of ways. Whenever you submit an application for the financial loan, the lender will pull a tough inquiry on your own credit score report which can reduced your rating by a number of points.

The knowledge supplied herein is for informational functions only and is not meant to be construed as click here Qualified assistance.

If you’re trying to find a home equity personal loan, just you should definitely get all the required information and facts from Each and every of your lenders you’re thinking of working with.

When doubtful, It really is by no means a foul thought to hunt the help of the economic Skilled (similar to a economic planner) if you're making use of for a private mortgage.

But you’ll desire to ensure that you have an understanding of what sort of personal loan is best for the scenario and how These month-to-month payments will match into your spending budget.

You do not make any typical payments and also your title isn't really over the deed or bank loan arrangement. You simply serve the goal of reassuring the lenders which the loan is going to be repaid.

A property finance loan refinance replaces your existing residence financial loan with another 1, normally with a unique fascination level and time period. A house fairness financial loan is often a 2nd home finance loan that permits you to withdraw dollars from a household fairness.

Scott Baio Then & Now!

Scott Baio Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Pauley Perrette Then & Now!

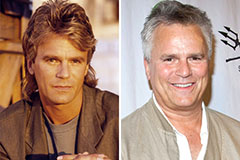

Pauley Perrette Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!